PCI DSS assessment

Full evaluation of your systems for PCI DSS compliance and identification of gaps.

Comprehensive security solutions for handling cardholder data

Full evaluation of your systems for PCI DSS compliance and identification of gaps.

AI-driven security scans to uncover weaknesses across your environment.

Official PCI DSS certification and security seal once compliance is achieved.

The Payment Card Industry Data Security Standard (PCI DSS) governs organizations that process, transmit, or store cardholder data. Compliance is both a legal obligation and essential protection against costly breaches.

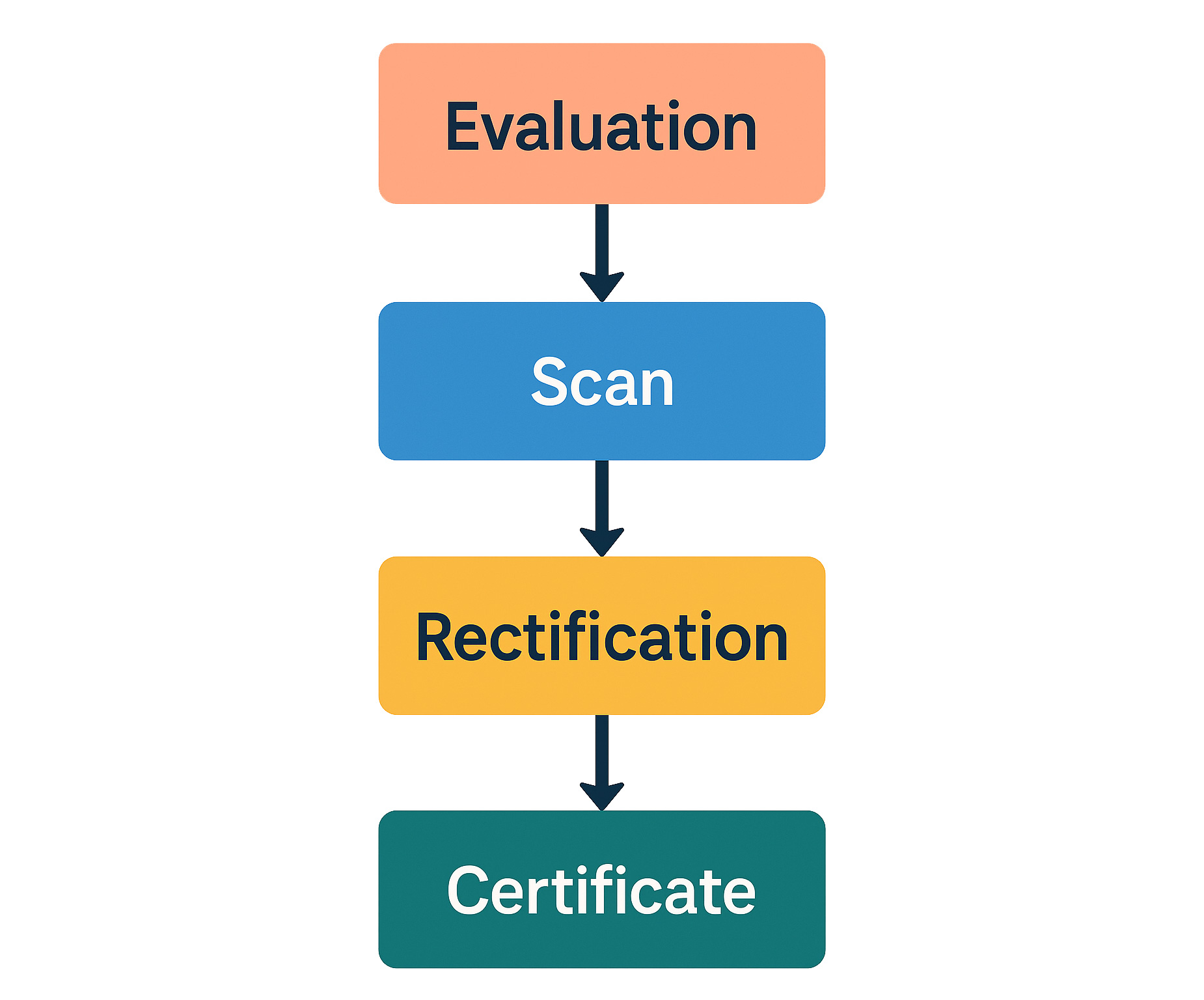

We guide you through the entire certification journey – from initial assessment and remediation to the final audit and issuance of certification.

Certification based on transaction volume

Over 6 million transactions per year – highest security requirements.

1–6 million transactions annually – elevated safeguards.

20,000–1 million transactions per year – standard safeguards.

Fewer than 20,000 transactions per year – baseline requirements.

Our scanner leverages AI to inspect your systems for weaknesses that jeopardize PCI compliance.

You receive a detailed report for every finding complete with prioritized remediation guidance.

We first determine which systems interact with cardholder data and identify the appropriate certification level. The level mainly depends on your annual transaction volume.

After systematic scanning we remediate any weaknesses. Once all controls meet the standard, you receive our certificate and the security seal.

Core areas of the standard

Firewall configuration and secure network architecture to protect cardholder data.

Strict access management and authentication for systems touching cardholder data.

Encryption of cardholder data in transit and at rest.

Our certified experts address discovered vulnerabilities for you. We implement the necessary safeguards to ensure full PCI DSS compliance.

From network segmentation and encryption to monitoring configuration, we deliver a fully compliant environment.

Compliance is an ongoing effort. We provide recurring checks and monitoring so your environment remains compliant.

Quarterly scans, annual assessments, and continuous oversight keep your payment infrastructure secure.

Answers to the most common certification questions

Any organization that processes, stores, or transmits payment card data – e-commerce, payment processors, hospitality, hospitality, and more.

Levels are based on annual transaction volume: Level 4 (under 20k), Level 3 (20k–1M), Level 2 (1–6M), Level 1 (over 6M transactions). Each level requires different validation steps.

Timelines depend on current security posture and complexity. Well-prepared environments finish in 2–4 weeks; extensive remediation projects can take 2–3 months.

Costs vary by level and remediation scope. We start with a free consultation and provide a tailored proposal based on your needs.